When data must be manually entered into multiple systems, the chances of human error increase exponentially. This can result in inaccurate financial reports and, ultimately, costly mistakes. Despite these workarounds, the lack of proper revenue recognition tracking in QuickBooks is a serious miss that could have devastating consequences for a business. Investors and creditors rely on financial statements to make informed decisions, and if those statements are inaccurate, it could lead to disastrous results. This is a major gap, as revenue recognition is a key accounting principle.

When a customer views or pays an invoice, you’ll receive an instant notification. Landlord Studio allows you to quickly and easily track rental income and expenses, generate professional reports, reconcile with your bank, and more. With Landlord Studio, you can automate time-consuming tasks and communications, such as rent reminders and tenant auto-pay. Plus, you can track income and expenses on an organizational, property, or unit level. However, because it’s integrated completely within QuickBooks, the sale, credit card fee, and cash deposit are all recorded automatically as they occur. The best thing about using QuickBooks Payroll is that it’s integrated with QuickBooks, so your financial statements are always up to date as of the latest payroll run.

- As part of customizing invoices, a “Pay Invoice” button can be added that allows customers to pay directly.

- When it comes to making decisions about the future of your company, you need to be sure that you’re using the best possible tools and QuickBooks doesn’t automate enough of the job.

- This is the most efficient, reliable, and secure method of accessing QuickBooks.

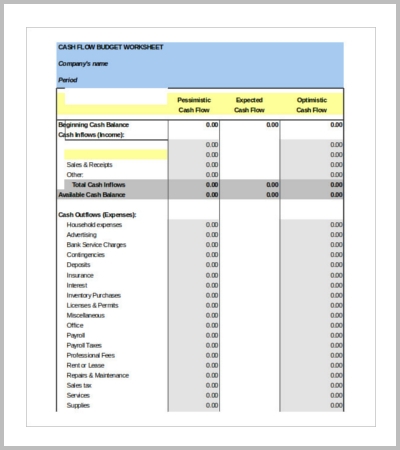

- Additionally, there are contact management, budgeting, reports, project management, time tracking, diary entries, and tax support.

QuickBooks users can invite an accountant to view their books, and QuickBooks Desktop users are able to export an accountant copy and import any changes the accountant has made to their file. If you use QuickBooks during the year, all you need to do at tax time is print your financial statements. Using QuickBooks to manage your personal finances essentially empowers you to take decisions backed by data and smart insights. Managing personal finances with a business tool, like QuickBooks, allows you to leverage powerful features. So, a Chromebook is good for QuickBooks so long as it is accessed correctly.

How does QuickBooks work for manufacturing companies?

She also regularly writes about travel, food, and books for various lifestyle publications. One of the best things about QuickBooks Online is that they have a user-friendly interface. All QuickBooks Online products have the same interface, and so do all the QuickBooks Desktop products.

Once connected, all bills you create in QuickBooks Online will automatically sync in real time to Wise, where you can choose which ones to pay. After selecting “Add Account,” search for the name of the financial institution and enter your login details. Businesses in all industries use QuickBooks primarily for accounting-related activities. When it comes to QuickBooks manufacturing, it is most useful for small-to-medium enterprises that can manually ensure inventory data is accurate and up-to-date. Unfortunately, QuickBooks’ accounting functions are relatively limited, and most users have to enter data volumes manually. You won’t have to worry about derailing sub-assemblies through raw inventory management.

The QuickBooks Online mobile app is available for download on Google Play and App Store, but you need an active subscription to use its features. Available in Plus and Advanced, the inventory management feature helps you track the quantity and cost of your inventory. As you sell inventory, QuickBooks will allocate a portion of your inventory to the cost of goods sold (COGS) automatically, which is an expense account that reduces your income. This allocation is a requirement for calculating taxable income and very cumbersome to do by hand. QuickBooks can also remind you to order inventory automatically when quantities are low.

The applications and documents that Chromebooks access and run are mostly on the cloud as opposed to regular machines that are designed to perform a majority of their operations locally. The standard also requires companies to consider whether there are any variables that could impact the amount of revenue that will ultimately be earned. This is relevant because many subscription services include some level of discount for prepaying for a longer period. Under ASC 606, revenue must be recognized when it is earned, which is typically when the underlying goods or services are delivered. This is a change from previous guidance, which allowed companies to defer recognition of revenue until it was earned. QuickBooks was designed to be used by employees who are in the same office as the company file.

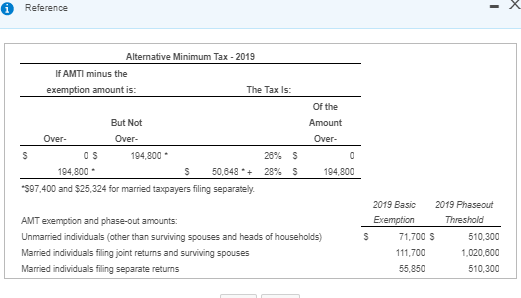

Manage taxes

QuickBooksis anaccounting softwarepackage developed and marketed byIntuit. Although it is the leading accounting software for small businesses, there are some limitations to using QuickBooks for real estate, particularly for managing rentals. In contrast, property management software like Landlord Studio has industry-specific features that are specifically designed to make rental property management easier. It offers invoicing, expense tracking, payroll management, and financial reporting features.

It is however recommended that there should be 3 Mbps internet access and 4 GB RAM. Chromebooks typically have much less processing power, storage space, and weight. Thus, it does not need much processing power or storage space as most of the information is stored on the cloud and not the devices. Consequently, Chromebooks have longer battery life and are very affordable making them ideal for netizens who spend most of their time on the Google Chrome web browser. Chromebooks are some of the most affordable systems with hardware components of a laptop. What distinguishes them from the regular machines is the fact that these are primarily designed to operate with an internet connection.

But whether or not you need an accountant will depend on the size and complexity of your business. QuickBooks is designed to be user-friendly, and there are plenty of resources available to help you learn the basics. QuickBooks also offers free online training courses that cover a variety of topics. There are plenty of resources available to help you learn how to use QuickBooks, including books, online tutorials, and community forums.

System Requirements for QuickBooks – Including Use on a Chromebook

For example, small businesses with international customers may choose to use QuickBooks Essentials, Plus, or Advanced. These subscription levels include the Multicurrency feature, which helps track international transactions. With QuickBooks’ manufacturing, you can access your production data in real-time and make better decisions to optimize your processes. Create financial reports according to representatives, individual items, product types, or customers. QuickBooks efficiently tracks inventory quantities for manufacturing businesses, including your raw materials list. A multi-user license is more common in companies and businesses, with several individuals working on a single file over a wide array of computers.

You will need to add sales tax details if you sell products and services. Businesses can use QuickBooks to automate invoicing, payments, and accounting. Smaller manufacturing companies use QuickBooks for inventory tracking, sales order fulfillment, powerful reports, and general business management.

Bookkeepers ensure that all financial transactions are properly recorded in the company’s books. Accounting focuses on providing decision-makers with financial information needed to make informed business decisions. Knowing when to use each one will help you keep your finances in order and make better decisions for your business.

Join over 7 million customers globally. Find the QuickBooks plan that works for your small business.2

To use the multi-user license, you must share the file over a network after hosting it on the cloud or a local computer. Each hosting technique has its advantages which we talked about in the methods. Another popular feature of QuickBooks is its ability to track inventory. If you sell products, QuickBooks can help you keep track of how many you have in stock, and it can automatically update your records when items are sold.

For managing everything from sales and purchases to inventory and production, using manufacturing ERP software would be advisable. You could also choose to hire a QuickBooks ProAdvisor through QuickBooks Live, an add-on to QuickBooks Online. One of the best ways to improve your cash flow is to offer customers the option to pay their invoices online. You can add QuickBooks Payments (formerly known as Intuit Merchant Services) so that customers can pay online directly from their emailed invoice.

QuickBooks Desktop 2023-A Step by Step Guide

Both a full-service and self-service payroll solution is offered by QuickBooks. Up to 50 employees can be paid by direct deposit or cheque by small firms, and the programme will automatically calculate and file your state and federal taxes. Creating invoices from scratch or an earlier estimate is made easier by QuickBooks. You may track the amount of unpaid invoices and the specifics of your account receivables and payables, and you can send the invoices to clients by mail, hard copy, or printout. Additionally, you can apply desired effects and customise the invoice to display your company logo. Advanced sales and customer relationship management functionality can be obtained by integrating Pipedrive CRM.

When you manage your account from the web you’ll also get additional features. For example, you can match your receipts to incoming bank transactions on the web. When you use your mobile app, you can only snap photos of your receipts. Additionally, our accountant view feature allows you to invite your accountant to view your accounts and run any of your financial reporting. This not only makes tax time easier, but by giving your accountant the tools to review your business financials you enable them to better help you achieve your long-term financial goals. SD House Guys, a company that buys houses for cash in San Diego, believes that proper digital reporting is what enables their rental property business to thrive.

If you’re interested in the companies that use QuickBooks, you may want to check out PeopleSoft and SAP ERP as well. In the other states, the program is sponsored by Community Federal Savings How To Start A Bookkeeping Business 2023 Guide Bank, to which we’re a service provider. This publication is provided for general information purposes only and is not intended to cover every aspect of the topics with which it deals.